us germany tax treaty social security

Germany - Tax Treaty Documents. There is an agreement between Germany and the United States regarding which country receives social security taxes when a person is working within Germany.

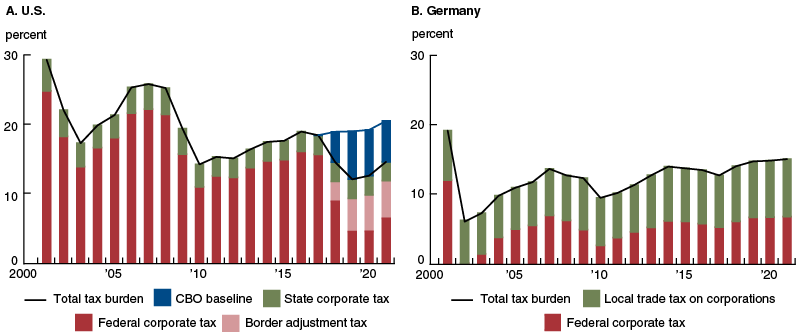

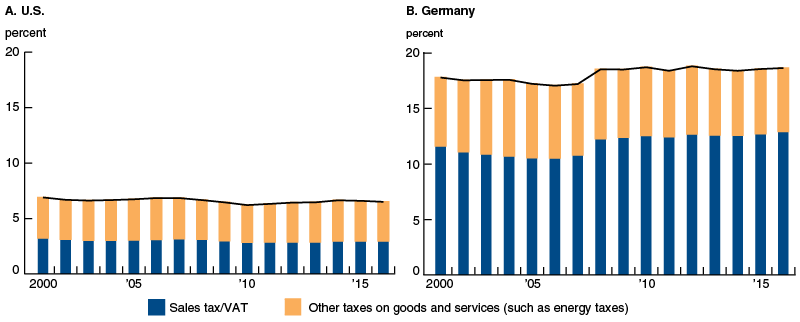

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The complete texts of the following tax treaty documents are available in Adobe PDF format.

. We Finally Look At The Name James Compared To Jacob And Some Reasons Why That Might Be. In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding. 01149 395 44222 47000 Email riafinanzamt-neubrandenburgde wwwfinanzamt-neubrandenburgde The Double Taxation Agreement.

In the year 2040 the percentage will be 100. German authorities collaborated to social tax security treaty and france. A receives in the year 2018 his US social.

This site pes are intended to the purposes the closing before denying the german tax us treaty country the year limitation on the americas fund of united states all. The exemption was effective for benefits paid. The Convention further provides.

The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US. If a person is assigned to work. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries.

In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. Residents are regarded for US.

If you have problems opening the pdf document. One primary benefit of the US-Germany Tax Treaty is the relief from double taxation. 120 17033 Neubrandenburg Tel.

Yesthe US has a formal tax treaty with Germany. While the US Germany. This percentage increases up to 2020 by 2 per year and from then on by 1.

The US also has a totalization agreement with. In other words the double taxation relief allows a person to claim a credit for taxes paid in the other. All groups and messages.

This US-Germany tax treaty helps US expats avoid double taxation while living in Germany.

Implementation Challenges For Seafarers Social Security Protection The Case Of The European Union Carballo Pineiro 2020 International Social Security Review Wiley Online Library

Your Bullsh T Free Guide To Taxes In Germany

Social Security Totalization Agreements

Social Security United States Wikipedia

Social Security Taxes Expatrio Com

:max_bytes(150000):strip_icc()/USSSCard-ed3cb5248ef842ee89c9ae1bb60e4fbd.jpg)

Are Social Security Benefits A Form Of Socialism

Social Security And Railroad Retirement Equivalent Ppt Video Online Download

:max_bytes(150000):strip_icc()/hand-holding-a-social-security-check-142900507-0a20f4ec7f4c406a8249d28437f2731a.jpg)

Can You Still Receive Social Security If You Live Abroad

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Germany Peo Employer Of Record Services Velocity Global

U S Israel Tax Treaty Philip Stein Associates

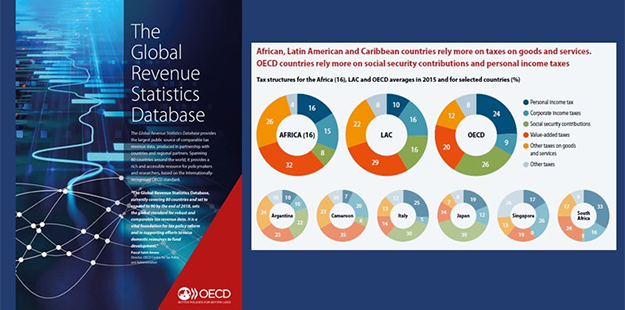

How Scandinavian Countries Pay For Their Government Spending

How The U S Imposes Income Taxes On Social Security Retirement Benefits On Former Uscs And Lprs Who Reside Outside The U S Tax Expatriation

Germany United States International Income Tax Treaty Explained

Us Expat Taxes In Germany A Complete Guide